A reality of financial operations is that some work never stops. Trying to prevent scams as they happen, asking customers if they recognise transactions, and chasing collections, are thankless tasks that pile up faster than most teams can handle.

But what if you could handle it all?

Today, we're launching a solution to a problem burning through operations teams at financial institutions everywhere: Outbound Conversations.

Your AI agent can now initiate contact via text, email, or voice to handle the operational work that never seems to stop.

What is an outbound support agent?

Excellent support means proactively reaching out to your customers before they know to reach you. But these conversations are time-consuming for human agents, especially when users are unresponsive or when the case requires multiple follow-ups to reach an outcome.

Worse, when you can’t get through it all, you need to triage, leaving some outreach never done.

Our outbound capability allows your AI agent to handle this work in a structured way, using the same intelligence, policies, and guardrails as your inbound procedures.

How does outbound AI differ from inbound AI?

With inbound support, customers drive the conversation. They make the requests, set the pace, and your agent (human or AI) follows their lead, always wrapping up with "is there anything else I can help you with?"

With outbound, your AI agent is in the driver's seat.

Our AI agent works just like a human support specialist who knows exactly what information they need. When a customer starts talking about something unrelated, the agent steers them back. "I understand, that sounds like it was really stressful. In order to help you, let's first verify this transaction." If more context is needed, it asks specific questions to accomplish its goal.

With outbound support, your AI agent runs the conversation to get the job done.

Is it similar to triggered marketing messages?

One-way proactive outreach has existed for decades in marketing, and there's no shortage of AI companies tackling it. Promotional emails, abandoned cart reminders, product announcements—these are well-trodden ground.

But who's focusing on operations teams? Especially in financial services?

That's where we come in. Our outbound support agent is not a one-way message blaster. It doesn't reach out to your customers to sell them new products. It reaches out to solve problems—sometimes theirs (verifying a potentially fraudulent charge), and sometimes yours (collecting a missing document that's holding up a compliance review).

Top Use Cases for Outbound Support Agents

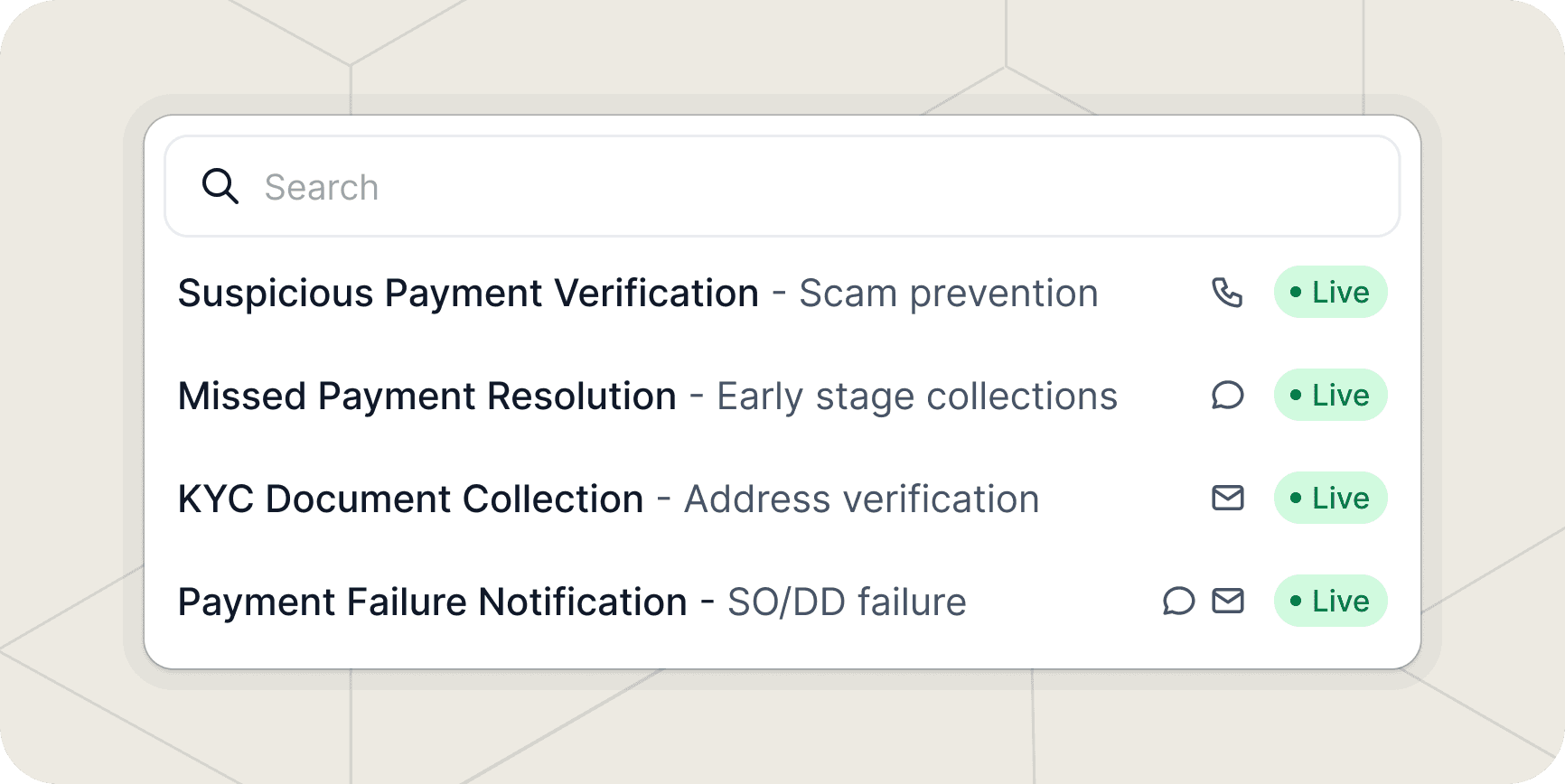

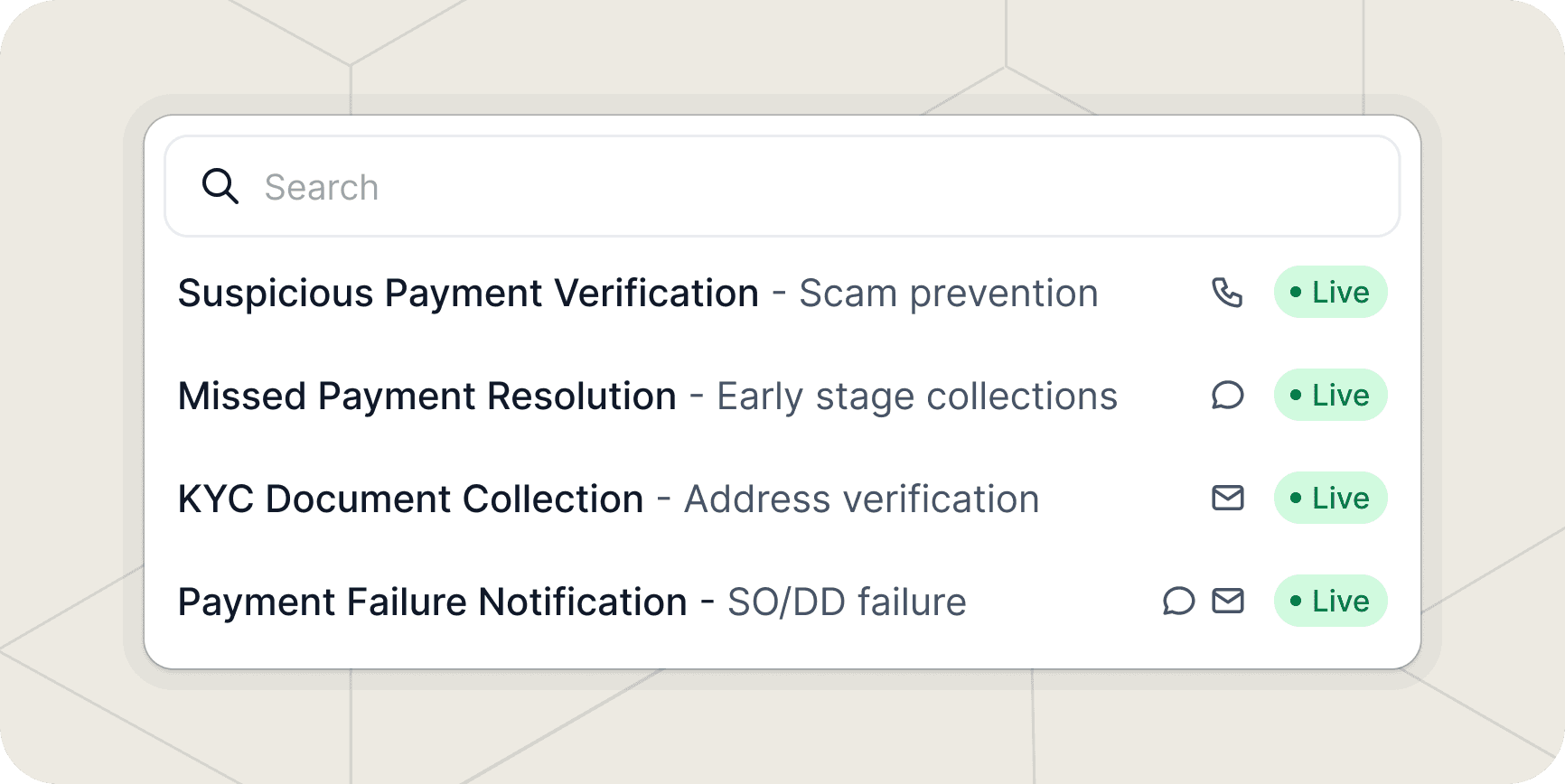

Outbound can be used for any process where your human agents currently reach out to customers, but some of the most common deployments we're seeing include:

Fraud Prevention: Reaching out to confirm suspicious transactions, gathering critical context to prevent financial crime.

Document Collection: Proactively requesting and validating missing information, systematically following up until cases are complete.

Payment Resolution: Guiding customers through failed payment scenarios while maintaining strict compliance.

Collections Management: Initiating contact for overdue payments, providing clear pathways for resolution.

What makes it work

Safety is the foundation

Financial services isn't a place for "good enough." A single misstep creates compliance risks that ripple outward. Our agent runs the same financial-services-specific guardrails as our inbound support, ensuring safety and compliance with every interaction. It understands regulations, recognises when it's out of its depth, and escalates to human agents when needed.

Seamless integrations

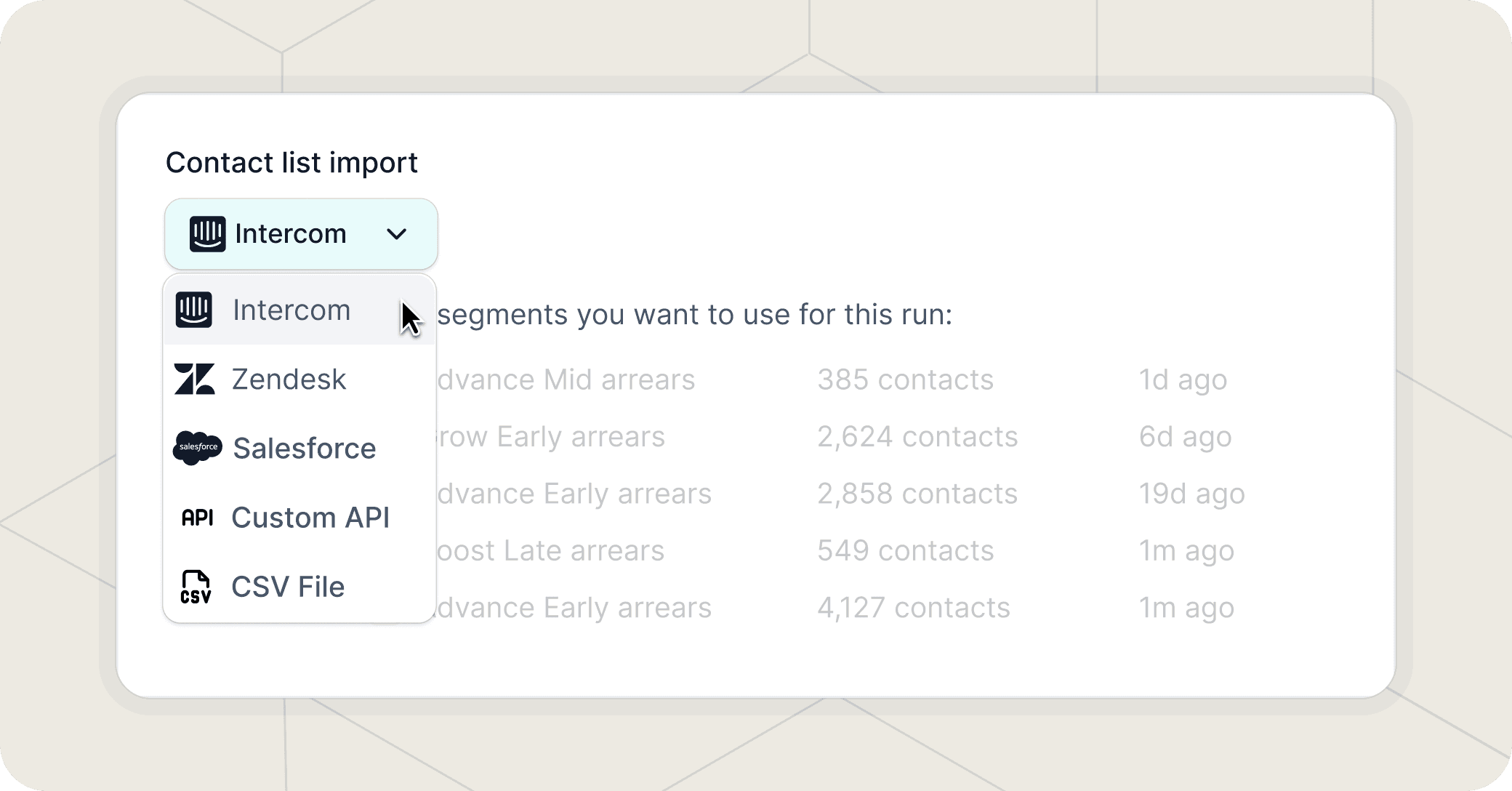

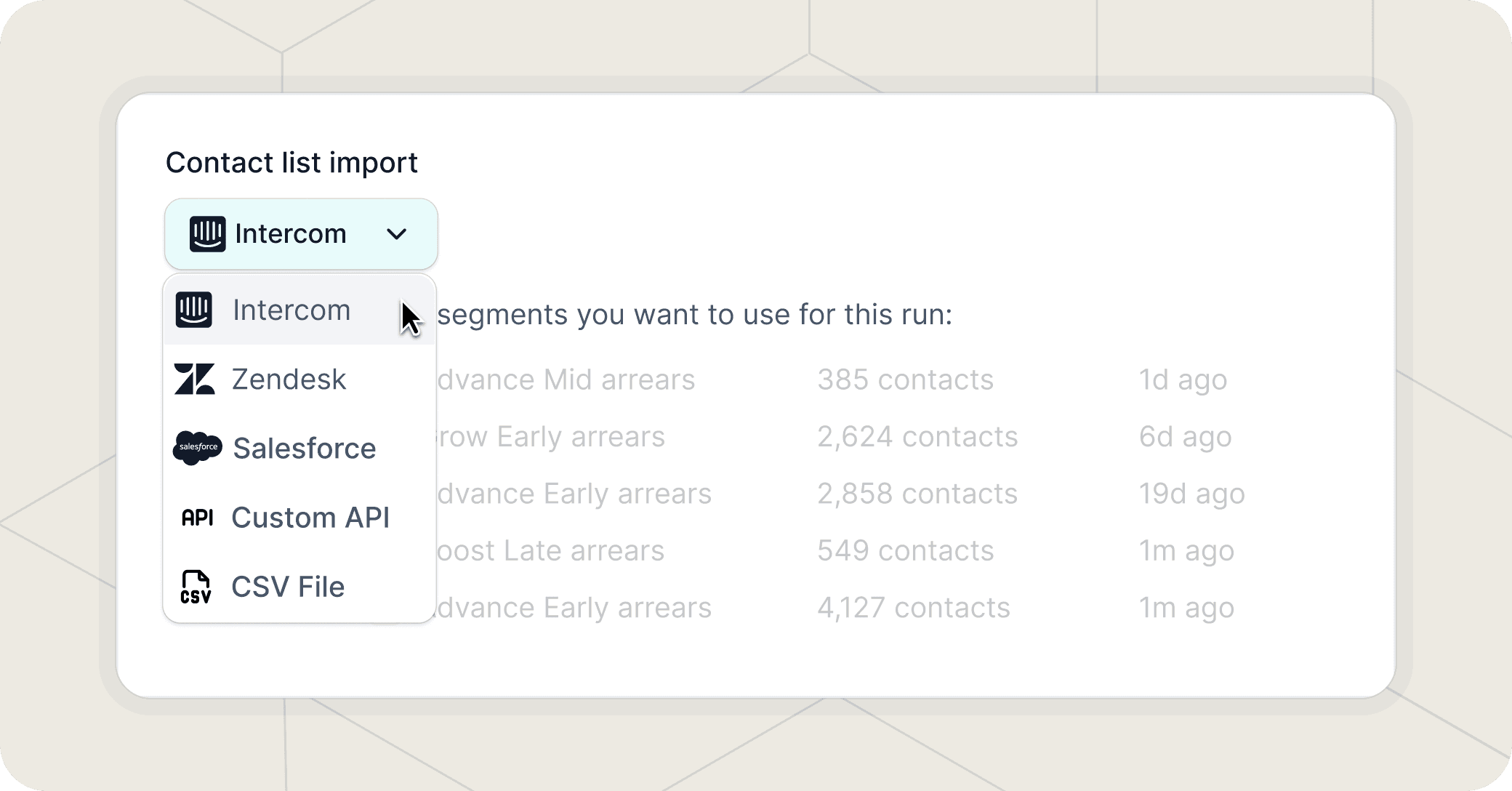

We designed Outbound to plug into how your team already works:

Deploy through API calls when your systems detect specific events

Use support desk integrations like Intercom or Zendesk

Trigger conversations via CSV uploads for batch operations

Initiate directly from back-office procedures

The agent handles the rest. It knows when it's achieved its goal, closes cases automatically, and escalates to your human team with full context when human judgment is needed.

The nitty gritty: must-have features of any outbound support agent

Batch Outreach: Trigger thousands of conversations simultaneously via CSV uploads or customer segments. Automate collection reminders, fraud alerts, or payment follow-ups across your entire customer base without drowning your team.

Multichannel: Reach customers through text, email, and voice. Meet them on their preferred communication channel instead of forcing them onto yours.

Voicemail Support: When customers don't pick up, our agent leaves appropriate, compliant messages tailored to the specific context. No generic "please call us back" nonsense.

Callback Requests: Customers can request a callback at a time that works for them, and the agent will honour that request.

The work that never stops? It just got manageable.

We're thrilled to launch an AI agent that can meaningfully help support teams that feel underwater. Our outbound agent handles the high-volume, back-and-forth work required to get cases over the finish line, autonomously and compliantly.

The collection calls your team can't make. The fraud verifications sitting in the queue. The documents that should have been collected three weeks ago. All of it can now move forward without adding headcount.

Ready to see it in action? Request a demo here.

A reality of financial operations is that some work never stops. Trying to prevent scams as they happen, asking customers if they recognise transactions, and chasing collections, are thankless tasks that pile up faster than most teams can handle.

But what if you could handle it all?

Today, we're launching a solution to a problem burning through operations teams at financial institutions everywhere: Outbound Conversations.

Your AI agent can now initiate contact via text, email, or voice to handle the operational work that never seems to stop.

What is an outbound support agent?

Excellent support means proactively reaching out to your customers before they know to reach you. But these conversations are time-consuming for human agents, especially when users are unresponsive or when the case requires multiple follow-ups to reach an outcome.

Worse, when you can’t get through it all, you need to triage, leaving some outreach never done.

Our outbound capability allows your AI agent to handle this work in a structured way, using the same intelligence, policies, and guardrails as your inbound procedures.

How does outbound AI differ from inbound AI?

With inbound support, customers drive the conversation. They make the requests, set the pace, and your agent (human or AI) follows their lead, always wrapping up with "is there anything else I can help you with?"

With outbound, your AI agent is in the driver's seat.

Our AI agent works just like a human support specialist who knows exactly what information they need. When a customer starts talking about something unrelated, the agent steers them back. "I understand, that sounds like it was really stressful. In order to help you, let's first verify this transaction." If more context is needed, it asks specific questions to accomplish its goal.

With outbound support, your AI agent runs the conversation to get the job done.

Is it similar to triggered marketing messages?

One-way proactive outreach has existed for decades in marketing, and there's no shortage of AI companies tackling it. Promotional emails, abandoned cart reminders, product announcements—these are well-trodden ground.

But who's focusing on operations teams? Especially in financial services?

That's where we come in. Our outbound support agent is not a one-way message blaster. It doesn't reach out to your customers to sell them new products. It reaches out to solve problems—sometimes theirs (verifying a potentially fraudulent charge), and sometimes yours (collecting a missing document that's holding up a compliance review).

Top Use Cases for Outbound Support Agents

Outbound can be used for any process where your human agents currently reach out to customers, but some of the most common deployments we're seeing include:

Fraud Prevention: Reaching out to confirm suspicious transactions, gathering critical context to prevent financial crime.

Document Collection: Proactively requesting and validating missing information, systematically following up until cases are complete.

Payment Resolution: Guiding customers through failed payment scenarios while maintaining strict compliance.

Collections Management: Initiating contact for overdue payments, providing clear pathways for resolution.

What makes it work

Safety is the foundation

Financial services isn't a place for "good enough." A single misstep creates compliance risks that ripple outward. Our agent runs the same financial-services-specific guardrails as our inbound support, ensuring safety and compliance with every interaction. It understands regulations, recognises when it's out of its depth, and escalates to human agents when needed.

Seamless integrations

We designed Outbound to plug into how your team already works:

Deploy through API calls when your systems detect specific events

Use support desk integrations like Intercom or Zendesk

Trigger conversations via CSV uploads for batch operations

Initiate directly from back-office procedures

The agent handles the rest. It knows when it's achieved its goal, closes cases automatically, and escalates to your human team with full context when human judgment is needed.

The nitty gritty: must-have features of any outbound support agent

Batch Outreach: Trigger thousands of conversations simultaneously via CSV uploads or customer segments. Automate collection reminders, fraud alerts, or payment follow-ups across your entire customer base without drowning your team.

Multichannel: Reach customers through text, email, and voice. Meet them on their preferred communication channel instead of forcing them onto yours.

Voicemail Support: When customers don't pick up, our agent leaves appropriate, compliant messages tailored to the specific context. No generic "please call us back" nonsense.

Callback Requests: Customers can request a callback at a time that works for them, and the agent will honour that request.

The work that never stops? It just got manageable.

We're thrilled to launch an AI agent that can meaningfully help support teams that feel underwater. Our outbound agent handles the high-volume, back-and-forth work required to get cases over the finish line, autonomously and compliantly.

The collection calls your team can't make. The fraud verifications sitting in the queue. The documents that should have been collected three weeks ago. All of it can now move forward without adding headcount.

Ready to see it in action? Request a demo here.

Share post

Copy post link

Link copied

Copy post link

Link copied

Copy post link

Link copied